We note that when depreciation expense is considered, EBT is negative, and therefore taxes paid by the company over the period of 4 years is Zero. Implementing an effective tax shield strategy can help increase the total value of a business since it lowers tax liability. Interest expenses on certain debts can be tax-deductible, which can make the entire process of debt funding much easier and cheaper for a business. This works in the opposite way to dividend payments, which are not tax-deductible. The recognition of depreciation causes a reduction to the pre-tax income (or earnings before taxes, “EBT”) for each period, thereby effectively creating a tax benefit.

- For instance, if you expect to have a high income next year(s), it might be wise to hold on to be able to lower your income in the future and avoid paying a higher tax rate.

- We note that when depreciation expense is considered, EBT is negative, and therefore taxes paid by the company over the period of 4 years is Zero.

- Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington.

- We note from above that the Tax Shield has a direct impact on the profits as net income will come down if depreciation expense is increasing, resulting in less tax burden.

Want To Learn More About Finance?

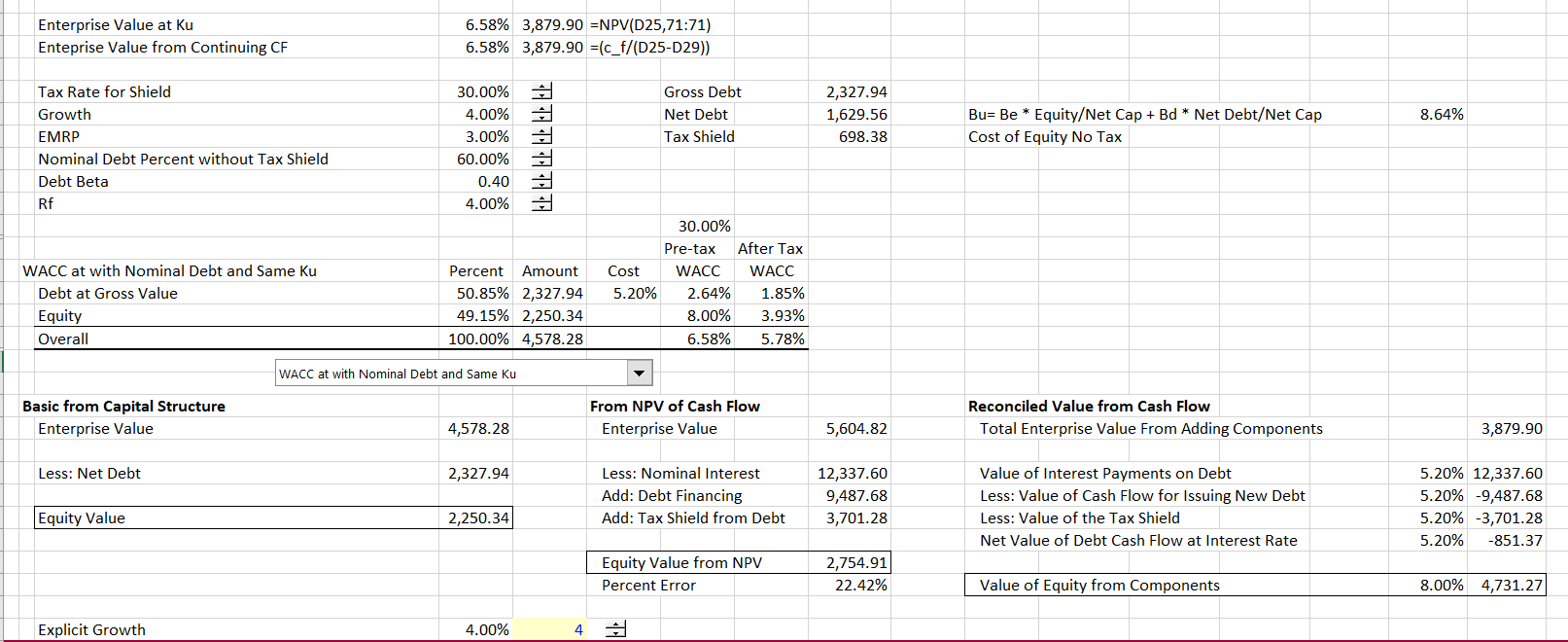

Since adding or removing a tax shield can be significant, many companies consider this when exploring an optimal capital structure. An optimal capital structure is a good mix of both debt and equity funding that reduces a company’s cost of capital and increases its market value. Businesses can use depreciation to spread out their tax deductions over time and manage their money better. By choosing the right way to depreciate their assets, they can lower their tax bills and have more cash for other things. The use of a depreciation tax shield is most applicable in asset-intensive industries, where there are large amounts of fixed assets that can be depreciated.

Impact of Accelerated Depreciation on the Depreciation Tax Shield

The maximum depreciation expense it can write off this year is $25,000. The tax shield Johnson Industries Inc. will receive as a result of a reduction in its income would equal $25,000 multiplied by 37% or $9,250. Anyone planning to use the depreciation tax shield should consider the use of accelerated depreciation. This approach allows the taxpayer to recognize a larger amount of depreciation as taxable expense during the first few years of the life of a fixed asset, and less depreciation later in its life. By using accelerated depreciation, a taxpayer can defer the recognition of taxable income until later years, thereby deferring the payment of income taxes to the government.

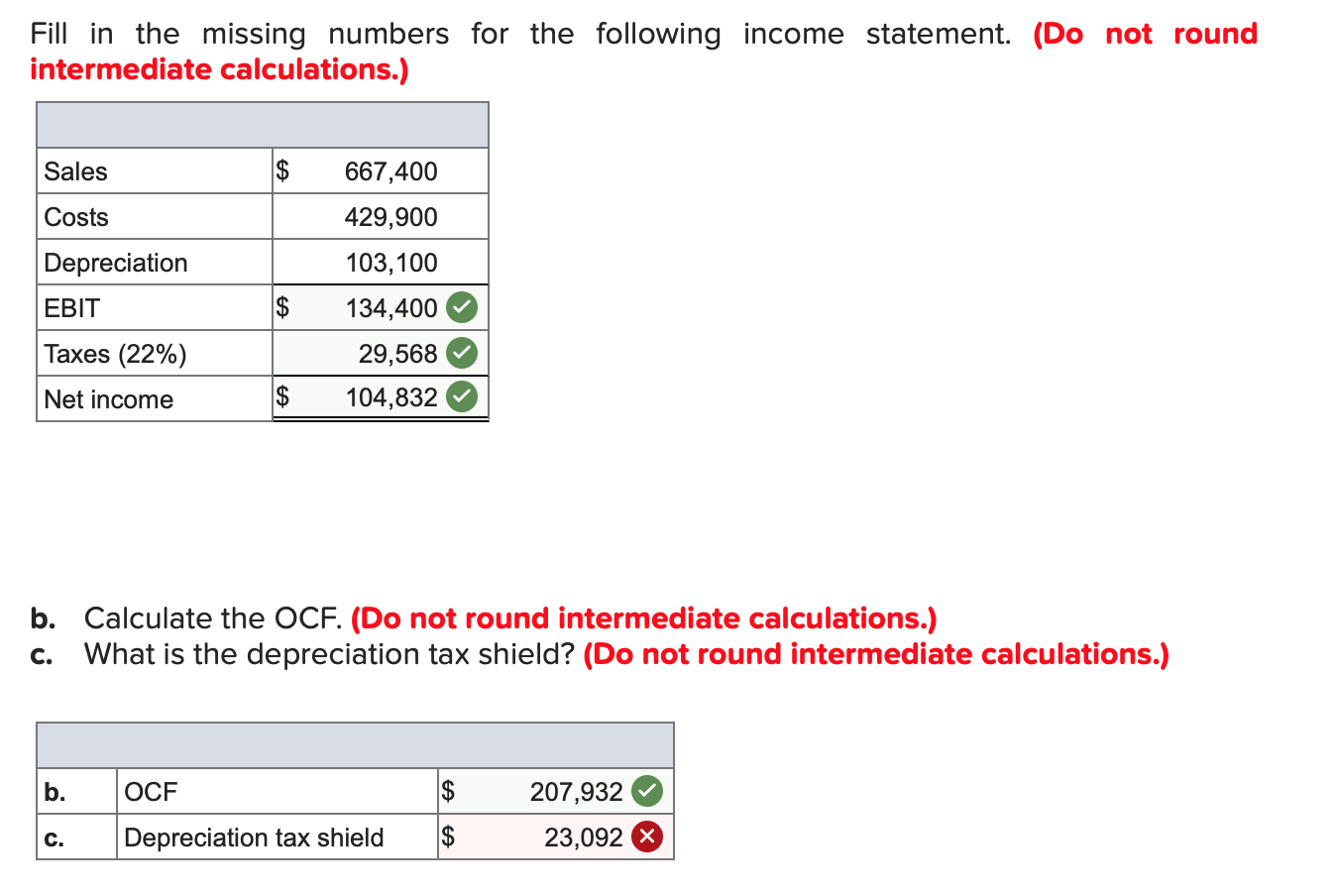

Example: Depreciation Method Tax Impacts

Tax shields can vary slightly depending on where you’re located, as some countries have different rules. In addition, it does not matter if you buy something with your own money or you borrow this money. For this reason, a depreciation tax shield is considered a big advantage to real estate investing. This amount in the profit and loss statement brings down the total revenue earned by the business, thus successfully leading to lower tax payments.

This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes. BooksTime is not responsible for your compliance or noncompliance with any laws or regulations. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. The Interest Payments are typically tax-deductible, which lowers the Company’s tax bill. First, when a Company borrows money (or ‘Principal’) from a Lender, they typically agree to repay the borrowed dollars in the future. As you can see, the Taxes paid in the early years are far lower with the Accelerated Depreciation approach (vs. Straight-Line).

However, the straight-line depreciation method, the depreciation shield is lower. It is to be noted that the process reduces the tax burden for the tax payer but does not eliminate it completely. A certain amount of tax obligation continues to remain with the asset. The concept is significant while making financial decisions in any capital-intensive business. The Depreciation Tax Shield Calculator assists in determining the financial benefit derived from the depreciation of assets, which can be deducted from taxable income. This tool is especially useful for businesses looking to maximize tax efficiency by leveraging asset depreciation.

The total amount of monthly deductions to the depreciation account is determined on the method best applicable for accounting for the regular wear and tear of a particular asset. Those tax savings represent the “depreciation tax shield”, which reduces the tax owed by a company for book purposes. On the income statement, depreciation reduces a company’s earning before taxes (EBT) and the total taxes owed for book purposes. Taxpayers who have paid more in medical expenses than covered by the standard deduction can choose to itemize in order to gain a larger tax shield. An individual may deduct any amount attributed to medical or dental expenses that exceeds 7.5% of adjusted gross income by filing Schedule A.

Therefore, the tax shield can be specifically represented as tax-deductible expenses. A tax shield is a way that you can reduce the total amount of taxes owed on your federal tax return. It’s an allowable deduction that you can take from your taxable income.

The good news is that calculating a tax shield can be fairly straightforward to do as long as you have the right information. You will need to know your individual tax rate as well as the amount of all your tax-deductible expenses. Have you ever wondered how depreciation affects how much taxes a business pays?

In the process, the amount of depreciation is used to reduce the income on which tax will be charged, thus bringing down the amount of tax payment. Here we see that depreciation acts as a shield against tax, a cash outflow for the business. A tax how to value noncash charitable contributions shield in capital budgeting is a way for corporations to strategically plan their optimal capital structure and decide which investments to follow. This, in turn, makes debt funding much cheaper since interest expenses on debt are tax-deductible.