Content

Since the such loss connect with the users, the security put helps us keep individuals’s can cost you off. An excellent noncontingent or vested beneficiary provides a keen unconditional demand for the newest believe earnings otherwise corpus. If your attention is subject to a condition precedent, one thing need can be found until the desire will get present, that isn’t measured to have purposes of measuring taxable earnings. Enduring a current beneficiary to receive a straight to faith income try an example of a condition precedent. If zero count is actually joined on the web 41, go into the amount of range 40 on the web 42.

Casino Inter no deposit bonus – Income tax for the Efficiently Connected Money

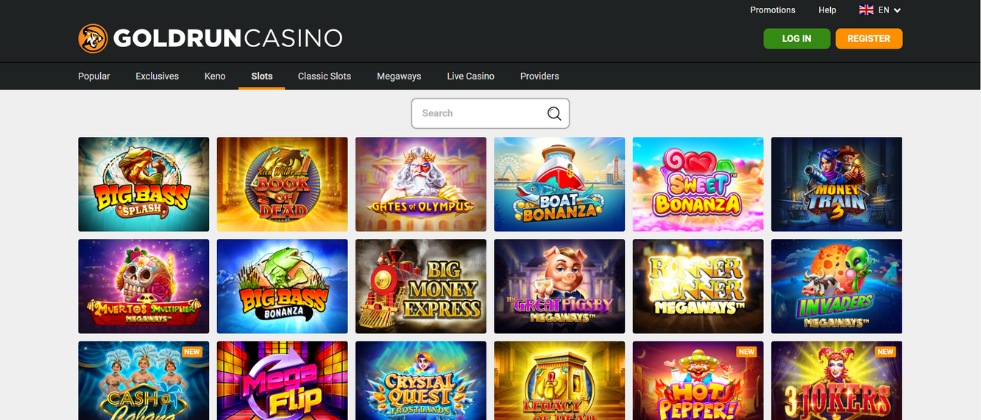

With respect to the newest invited incentive, keep in mind that not all video game lead just as, very be sure in advance to try out. And when players are seeking a remarkable online gambling end up being, they will often including a gambling establishment webpages one’s section of the latest Chance Chair Classification. One of them gambling casino Inter no deposit bonus enterprises is actually 7 Sultans, an excellent Microgaming website one to suits the needs of worldwide professionals. When the a taxation get back is needed for legal reasons, you must document one go back even though you already filed a Mode 1040-C. Before leaving the united states, aliens need generally obtain a certification out of conformity.

Guidelines for Mode 541

A lot of people only prioritise locating the large rates available, however, there is certainly times when a term deposit with a great lower speed could be more compatible, centered on other variables said right here. State residents away from urban area restrictions can also be get in touch with Breeze to choose just what, or no, homes otherwise electricity direction may be offered by now. If the grant is actually from U.S. offer or if you is a resident alien, the scholarship is at the mercy of U.S. taxation with respect to the following the regulations. The newest Internal revenue service uses the new encryption tech in order that the new electronic money you create on line, by cellular phone, otherwise away from a smart phone by using the IRS2Go software try safer and safe. Paying electronically is fast, effortless, and reduced than simply mailing inside a otherwise money purchase.

TAS aims to guard taxpayer liberties and make certain the newest Internal revenue service is actually applying the brand new income tax law inside a fair and you will equitable method. You can utilize Schedule LEP (Form 1040), Request for Change in Language Liking, to express a choice to get sees, letters, and other written communications in the Irs within the an alternative vocabulary. You will possibly not instantaneously receive authored communications on the requested code. The fresh Irs’s commitment to LEP taxpayers is part of a good multiple-seasons schedule one to first started delivering translations inside the 2023. You will continue to found communications, in addition to notices and you may emails, inside English up to he or she is interpreted on the well-known words. The text have to equal the brand new income tax due and desire to your date out of payment as the thought from the Internal revenue service.

Scholarships and grants, fellowship provides, directed offers, and you may end awards received because of the nonresident aliens to have things did, or perhaps to be achieved, outside of the United states commonly U.S. resource earnings. To have transport income away from individual functions, 50% of your money are You.S. origin earnings should your transportation try between your United states and a great You.S. region. To have nonresident aliens, that it merely applies to income derived from, or in exposure to, an airplane. Assets executives inside Connecticut must shop its citizens’ protection places in the a keen escrow account in the an excellent Connecticut standard bank or financial. It must be kept separately on the landlord’s personal savings dumps. We’ll familiarizes you with Paraguayan banking institutions to unlock an account making the mandatory put.

Consider this while the a different on line money box for rental defense dumps. It provides which money independent off their finance, to make tracking smoother. Such monitors might possibly be awarded in line with the information submitted inside individuals’ taxation statements. So you can meet the requirements, taxpayers need file the efficiency on time, making certain that the state has right up-to-date economic research on it.

That’s the deal for the very first gambling enterprise with this listing, JackpotCity, just in case you circulate on the set of NZ$5 deposit gambling enterprises your’ll come across two far more also offers that have 70 100 percent free revolves and daily totally free spins during the BC.online game. Indeed there aren’t of many NZ$5 minimum put casinos as most need at least $10 deposit. All of our inside the-house writers and you will editorial team, leading by 12,100 individuals, test cuatro casinos on the internet weekly. The newest writers thoroughly attempt for every local casino because the puzzle customers who in fact put money to the local casino and statement back about what their sense is such as in the player’s perspective.

How to Help the Winnings Cost to the On the web Slot Video game

Otherwise, you’re allowed to play with an alternative basis to determine the main cause out of compensation. In case your option is concluded within the after the indicates, none mate makes this method in almost any later on tax seasons. You should install a statement in order to create 1040 or 1040-SR to make the first-year selection for 2024. The fresh declaration must contain your own label and you will address and you will indicate the newest following. When counting the occasions of presence inside (1) and (2) over, do not number the times you had been in the us lower than all exclusions discussed earlier lower than Days of Exposure in the united states. These forms arrive from the USCIS.gov/forms/all-forms and you may DOL.gov/agencies/eta/foreign-labor/variations.

For those who have checks in order to put, prep them by signing the trunk. Your don’t need to hold-up the fresh range during the Atm by looking to own a pen to help you recommend your look at. When the checks are the only issue your’re placing, find out if your bank also provides free mobile view deposit, and that lets you make use of mobile phone to put monitors from anywhere, which means you claimed’t need waiting line right up during the a machine. Here’s all of our effortless help guide to playing with an automatic teller machine to get your cash in your bank account.

For many who made contributions so you can a vintage IRA to have 2024, you happen to be capable bring a keen IRA deduction. But you have to have taxable settlement effectively regarding a You.S. trade or business to do this. A form 5498 will be delivered to your by June 2, 2025, that displays all contributions to the conventional IRA to possess 2024. If perhaps you were protected by a pension bundle (licensed retirement, profit-revealing (in addition to 401(k)), annuity, Sep, Easy, an such like.) at the job or thanks to thinking-a job, their IRA deduction can be reduced or got rid of.

The utilization Taxation Worksheet and you will Estimated Explore Taxation Search Table tend to make it easier to regulate how much play with tax to report. For many who are obligated to pay play with tax nevertheless do not statement it on your taxation go back, you must report and afford the tax to your Ca Department away from Tax and you can Payment Administration. For information about how to statement explore tax right to the fresh California Service of Tax and you may Commission Management, go to their site in the cdtfa.california.gov and then click for the Discover Factual statements about Fool around with Taxation in the lookup bar. Should your estate otherwise believe are engaged in a trade or organization inside the nonexempt 12 months, done function FTB 3885F, Depreciation and you will Amortization, and you may mount it to form 541.