For example, if you raise the price of a product, you’d have to sell fewer items, but it might be harder to attract buyers. You can lower the price, but would then need to sell more of a product to break even. It can also hint at whether it’s worth using less expensive materials to keep the cost down, or taking out a longer-term business loan to decrease monthly fixed costs. As the owner of a small business, you can see that any decision you make about pricing your product, the costs you incur in your business, and sales volume are interrelated. Calculating the breakeven point is just one component of cost-volume-profit analysis, but it’s often an essential first step in establishing a sales price point that ensures a profit. That’s the difference between the number of units required to meet a profit goal and the required units that must be sold to cover the expenses.

Breaking even is the first step toward a healthy business

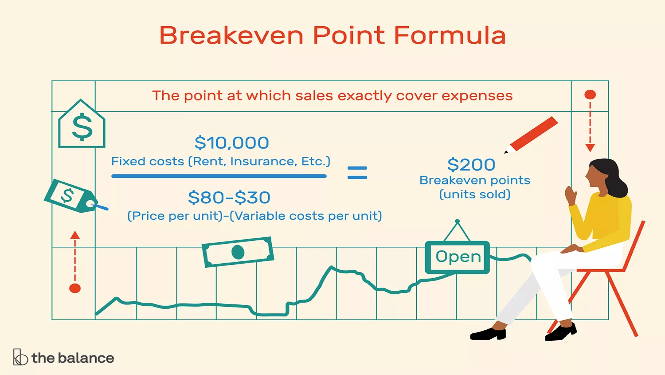

To do this, calculate the contribution margin, which is the sale price of the product less variable costs. Your company can use the cost totals to estimate the cash needed to generate sales of 50,000 units. The break-even point is your total fixed costs divided by the difference between the unit price and variable costs per unit. Keep in mind that fixed costs are the overall costs, and the sales price and variable costs are just per unit. Typically, this analysis works best for businesses that focus on a single product or service. The analysis becomes more complex and less accurate if you offer a wide range of products with different price points and variable costs.

Increase profits using financial analysis

He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The break-even point or cost-volume-profit relationship can also be examined using graphs. This section provides an overview of the methods that can be applied to calculate the break-even point.

Introducing a new product or service

The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even analysis to measure its repayment of debt or how long that repayment will take. For information pertaining to the registration status contract issues when buying an accounting or cpa practice of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The basic objective of break-even point analysis is to ascertain the number of units of products that must be sold for the company to operate without loss.

Consolidated Financial Statements: Requirements and Examples

- The break-even point allows a company to know when it, or one of its products, will start to be profitable.

- Break-even analysis is an important way to help calculate the risks involved in your endeavor and determine whether they’re worthwhile before you invest in the process.

- When starting a new business, this analysis can help you find out if your business idea is financially viable before you invest too much time or money.

- We believe everyone should be able to make financial decisions with confidence.

- So, he decides to calculate the break-even point, so that he and his management team can determine whether this new product will be worth the investment.

He is considering introducing a new soft drink, called Sam’s Silly Soda. He wants to know what kind of impact this new drink will have on the company’s finances. So, he decides to calculate the break-even point, so that he and his management team can determine whether this new product will be worth the investment. Decide on the selling price for each unit of your product or service. The higher the variable costs, the greater the total sales needed to break even. You can use the break-even point to find the number of sales you need to make to completely cover your expenses and start making profit.

What Is Break-Even Analysis?

If your price is too high, you might be falling short of your break-even point because customers won’t buy at that price. Lowering your selling price will increase the sales needed to break even. But this can be offset by the increased volume of purchases from new customers.

Fortunately, you can answer this question by calculating your break-even point. Not sure where to start or which accounting service fits your needs? Our team is ready to learn about your business and guide you to the right solution. From this analysis, you can see that if you can reduce the cost variables, you can lower your breakeven point without having to raise your price. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

Here are a few ways to lower your break-even point and increase your profit margin. Let’s say you’re trying to determine how many units of your widget you need to produce and sell to break even. Once you’ve decided whether you want to find your break-even point in sales dollars or units, you can then begin your analysis. Calculating the break-even point in sales dollars will tell you how much revenue you need to generate before your business breaks even. Here are four ways businesses can benefit from break-even analysis.